What happened?

Over the weekend (on May 3rd), a group of eight OPEC+ countries announced they will accelerate the return of oil supply to global markets. Beginning in June, the group will add an additional 411,000 barrels per day. Combined with a similar announcement last month, this means nearly half of the 2.2 million barrels per day in voluntary production cuts will be reversed sooner than expected.

Quick background:

In 2023, eight OPEC+ countries (Saudi Arabia, Russia, Iraq, United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman) voluntarily reduced global oil supply by 2.2 million barrels per day through voluntary production cuts to help stabilize prices. These cuts were originally scheduled to be gradually phased out starting in March 2024, but the timeline was delayed multiple times. In December 2024, the group outlined a slower return of volumes from April 2025 through September 2026.

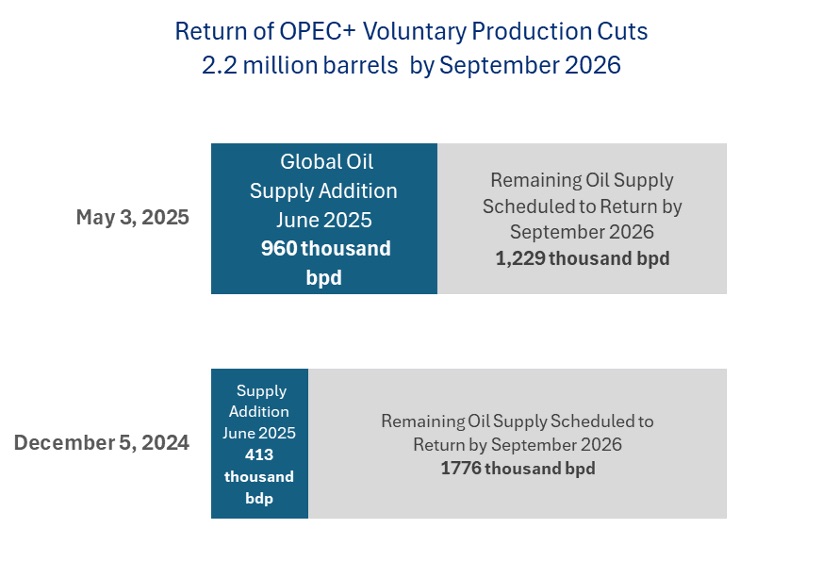

However, at its April and May 2025 meetings, OPEC+ reversed course, accelerating the timeline. The illustration below highlights the original OPEC+ plan to return 413,000 barrels per day by June 2025, compared to the updated plan that now aims to return 960,000 barrels per day starting in June 2025.

Was this expected or is it a surprise?

Yes and no. In general, oil market analysts did not expect the eight OPEC+ countries to accelerate the return of oil volumes for a second consecutive month – especially amid such economic uncertainty.

However, speculation about this announcement began circulating across several news outlets late last week.

Meanwhile, U.S. oil prices (WTI) declined by 19% between April 2 and May 2. OPEC+ made a surprise move on April 3, adding back 411,000 barrels per day – effectively compressing three months’ worth of volume returns into a single month.

Why is OPEC+ increasing the global oil supply now?

At face value, boosting supply in the face of soft demand growth might seem counterintuitive. However, we believe the main goal is to enforce compliance with existing production agreements originally set when the voluntary production cuts were announced in 2023.

Several OPEC+ members, namely Kazakhstan, Iraq, and Russia, have been producing above their agreed-upon quotas. If they were to align production with their targets, analysts estimate that only about half of the 960,000 barrels per day scheduled to return by June would actually hit the market.

What do we expect for oil prices?

The global oil market is likely to tip into oversupply—by an estimated 300,000 to 500,000 barrels per day—starting in June.

This could push oil prices temporarily into the low $50s. However, over the long term, we expect prices to stabilize in the $60–$80 per barrel range.

It’s important to keep in mind that most OPEC members require oil prices above $80 per barrel to balance their national budgets—except for the UAE, which has a lower fiscal breakeven threshold.

What happens next?

Historically, the cure for low oil prices is low oil prices. Several factors could help rebalance the market and support a recovery:

- Rising demand driven by increased consumption of gasoline, diesel, and other petroleum products as prices fall

- Improved compliance from Kazakhstan, Iraq, and Russia with agreed-upon production limits

- Stricter U.S. sanctions on Iran, potentially curbing its oil exports

A slowdown in U.S. production growth, as short-cycle shale producers pivot to maintenance mode—even as natural gas and NGL production continue to grow

How does this impact the U.S. energy sector?

Global energy demand has grown in 40 of the past 42 years – and that trend is expected to continue. Crude oil demand is also projected to rise in 2025.

As the world’s largest producer and exporter of energy, the U.S. remains a cornerstone of global supply.

Since 2020, capital discipline has transformed the U.S. energy sector. Today, most companies are in their strongest financial position in decades—with healthy balance sheets, low debt, and robust free cash flow enabling dividends and share buybacks even during price downturns.

That said, producers and oilfield services firms with revenues tied directly to commodity prices will likely see near-term cash flow pressures.

In contrast:

- Energy infrastructure operators with fee-based models should be largely insulated

- Refiners may benefit from increased product demand and potential margin expansion

- Utilities are expected to remain unaffected by oil price volatility

What does this mean for Tortoise’s investment strategy?

At Tortoise, we believe the global energy landscape is shifting—with natural gas playing an increasingly critical role in the energy mix.

We anticipated a potential OPEC+ move and positioned our portfolios accordingly.

Our energy infrastructure strategies focus on companies with fee-based business models—minimizing exposure to commodity price swings—while capturing the upside of rising natural gas demand.

Our electrification strategies target investments in electric generation and infrastructure. We do not expect these segments to be materially impacted by lower oil prices.

Within our broad energy strategies, we’ve reduced exposure to commodity-sensitive names and increased allocations to infrastructure and utilities.

At Tortoise, we believe energy powers everything—from homes and hospitals to data centers and global commerce. Investing in energy is about investing in the infrastructure of modern life. And we remain focused on delivering long-term value through smart positioning, disciplined management, and a deep understanding of global energy markets.

To learn more, contact us.

Disclosures

Nothing contained in this communication constitutes tax, legal, or investment advice. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. This communication contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical fact, included herein are “forward-looking statements.” Although Tortoise Capital believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual events could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements. This communication reflects our views and opinions as of the date herein, which are subject to change at any time based on market and other conditions. We disclaim any responsibility to update these views. These views should not be relied on as investment advice or an indication of trading intention. Discussion or analysis of any specific company-related news or investment sectors are meant primarily as a result of recent newsworthy events surrounding those companies or by way of providing updates on certain sectors of the market. Tortoise Capital, through its family of registered investment advisers, does provide investment advice to Tortoise related funds and others that include investment into those sectors or companies discussed in this communication. As a result, Tortoise Capital does stand to beneficially profit from any rise in value from many of the companies mentioned herein including companies within the investment sectors broadly discussed.